Local government entities continue to be targets of cyber-crimes and data breaches. MCIT’s privacy or security event liability and expense coverage, otherwise known as cyber coverage, can help manage the fallout of an incident.

This is a claims-made and -reported coverage and includes:

- Privacy or security event liability

- Privacy response expense: Includes costs of services of a security expert designated by MCIT, a legal review consultant designated by MCIT, notification to affected individuals, identity theft protection services for affected individuals and public relations services

- Regulatory proceedings and penalties

- PCI-DSS (payment card industry data security standards) assessments

- Electronic equipment and electronic data damage: Includes expenses to determine whether electronic data can be restored and costs to restore data

- Network interruption costs: Includes expenses to reduce the loss, extra expense incurred, expenses of preparing proof of loss and third-party forensic accounting services

- Cyber-extortion expenses: Covers costs of cyber-extortion threat, including ransom payment, under MCIT consent

Computer Fraud and Misdirected Payment Fraud Endorsement

Computer fraud and misdirected payment fraud costs are covered by endorsement issued to all members:

- Computer fraud: Pays direct financial loss of money fraudulently obtained from the member due to unauthorized access of the member’s computer system by a person who is not an employee

- Misdirected payment fraud: Pays direct financial loss of money fraudulently obtained from the member due to an intentional and criminal deception of the member by a person who is not an employee

Local Contacts and Handling of Claims

MCIT works with members in handling and adjusting each cyber claim or regulatory proceeding and has established agreements with specialists to assist with the claim response process, such as:

- Computer forensic experts

- Data breach coaches

Videos Summarize Coverage Terms, Conditions, Exclusions

View Cyber Coverage Definitions video

View Types of Cyber Coverage and Their Limits

View Cyber Coverage Conditions

The Coverage Summary booklet summarizes the cyber coverage provided through MCIT, including conditions and exclusions.

The Coverage Summary booklet summarizes the cyber coverage provided through MCIT, including conditions and exclusions.

Coverage Summary for Agricultural Societies (County Fairs)

The Coverage Summary Guide for Agricultural Societies specifically focuses just on the lines coverage most pertinent to the operations of a county fair.

Help with Managing Cyber- and Data Security Risks

Guide Offers Organizationwide Approach to Managing Cyber Risks

Guide Offers Organizationwide Approach to Managing Cyber Risks

This guide addresses risk exposures for public entities related to data security. It provides tips for the member to develop an organizationwide approach to data security across all departments and employees. This is not a technical resoruce for IT professionals.

Checklist to Identify Cyber Exposures

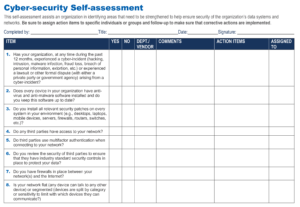

To assist members in their data security efforts, the Cyber-security Self-assessment is a broad checklist that an organization uses internally to help identify data security areas it needs to strengthen.

The assessment asks yes-no questions and provides areas for comments and action items, as well as to whom the action items are assigned.

No-cost Assistance Is Just a Call Away

No-cost Assistance Is Just a Call Away

MCIT’s risk management and loss control consultants can assist members in identifying and managing their data security risks, as well as answer questions about MCIT’s cyber-coverage.

eRiskHub® Offers Wealth of Cyber-security Resources

MCIT members have access to eRiskHub, a restricted third-party website dedicated to helping organizations understand and manage their cyber risks.

The site includes:

- Guides for developing incident response plans

- Sample policies around cyber and data security

- Tabletop exercises to practice incident response plans

- Cyber-security training tools to support employee awareness efforts

- Phishing- and ransomware-specific information and tools

- More!

MCIT recommends that members modify materials (e.g., policies, plans) to fit their specific needs, as well as terms and conditions of MCIT coverage.

Register to Access Site

Individuals must first set up a site log in using the MCIT code to access eRiskHub. The access code has been shared with members’ primary contacts. If needed, members may contact MCIT to request the code again.

eRisk Hub is operated and maintained by NetDiligence,® a company of Network Standard Corporation. MCIT is not responsible for the site’s content nor does it endorse any specific product on the site.

Report a Claim

Submit all cyber claims to MCIT through the member portal (access through orange button at top or bottom of page).